We live in a time where falling sick can spell financial disaster due to the rising medical costs in Singapore. Luckily, our prayers were answered in 2015, when the Ministry of Health launched MediShield Life to address the growing need for a basic health insurance plan.

What is MediShield Life?

Medishield Life automatically enrolls all Singaporeans and Permanent Residents (PR) to provide individual, life-long, basic medical protection. It covers outpatient treatments or day surgery in government hospitals by paying for the portion of your bill within the claim limits (minus the deductible and co-insurance).

MediShield Life is enacted under the MediShield Life Scheme Act administered by the Central Provident Fund (CPF) Board and in partnership with the Ministry of Health.

MediShield Life Premiums

The premiums you pay for your MediShield Life increase as you age. What’s great is that it is fully payable with our MediSave. Depending on your income level, you might even be able to receive Government subsidies of 15% – 50%. Other subsidies such as Pioneer Generation Subsidies, Merdeka Generation Subsidies, and COVID-19 Subsidies are also available.

However, it is important to note that if you are a PR, the amount of subsidies you receive at public hospitals will be less than what Singaporeans receive. This will mean that you are likely to pay higher out-of-pocket charges.

To check the MediShield Life premium you are required to pay, head over to the “Coverage and Premium” section on the “Healthcare Dashboard” or use the ‘Premium Calculator’ to calculate the amount.

While MediShield Life covers all pre-existing illnesses, you will have to pay an Additional Premium of 30% for the first 10 years if you suffer from the following conditions. Following that, you will be subject to the same normal premiums based on your age group.

Check Outstanding MediShield Life Premiums

You can also check your outstanding premiums, along with any interests or penalties, by logging into ‘View my Outstanding MediShield Life Premiums’.

Arrange Premium Payments

If you have insufficient MediSave to complete your premium payments, you can top it up by using the e-Cashier function on the CPF website.

You can also choose to use your MediSave to pay your dependent(s)’ MediShield Life premiums by requesting to change the payer for their MediShield Life Cover. Payment for dependent(s)’ MediShield Life premiums can also be stopped anytime.

Suspend Premium Payments

You are not allowed to opt out of MediShield Life and have to continue to pay the premiums over your lifetime. Only when you are permanently located overseas, then you can apply to suspend your MediShield Life premium payments.

MediShield Life Deductibles & Co-Insurance

What Is A Deductible?

A deductible is a fixed amount you will pay (from MediSave and/or in cash) before any payout from MediShield Life. Deductibles are only payable once every policy year and range from $1500 to $3000 depending on age and ward class.

For example, if you are 35 years old and staying in a B2 ward, you will have to pay up to $2000 in deductibles before MediShield Life makes any payout.

What Is Co-Insurance?

You will also be responsible for paying co-insurance, which represents the percentage of costs you will pay after you have paid your deductible. The co-insurance payable decreases as the hospital bill increases. With MediShield Life, the co-payment begins at 10% and decreases ad the claimable amount increases.

To find out more information about MediShield Life co-insurance, visit the Ministry of Health website for more information.

MediShield Life Coverage

MediShield Life covers government hospital bills up to B2 ward and below. If you choose to stay in class A/B1 wards or private hospitals where bills are much higher, MediShield Life will only cover a small portion of the bill. MediShield Life also covers care in community hospitals and inpatient palliative care services.

It is important to understand that there is a sub-limit for each treatment. For the exact coverage, you may read more on the CPF website.

However, MediShield Life has its exclusions such as ambulance fees, vaccination, cosmetic surgery, dental work (except due to accidental injuries), overseas medical treatment or maternity charges, and more. For a full list of exclusions, visit the Ministry of Health website.

What Options Do I Have To Upgrade My MediShield Life?

By now, you would have known that MediShield Life only provides basic coverage and benefits. If you want to enhance your MediShield Life coverage and benefits, you can choose to purchase an Integrated Shield Plan (IP) with or without a Rider.

Integrated Shield Plan (IP)

Integrated Shield Plans (IP) are private insurance plans that can provide additional coverage. IP plans have 2 components to them:

- MediShield Life (which you will be already covered by)

- Additional private insurance

One of the greatest benefits of getting an IP is that you have the option to stay in private hospitals or upgrade to A/B1 wards while being covered. This allows you more flexibility in choosing your preferred doctor with the possibility of having shorter waiting times.

Most IPs provide pre and post-hospitalisation coverage while MediShield Life does not cover this aspect. With MediShield Life, there is also a limit to the inpatient and outpatient treatments and any excess will have to be paid out of your own pocket. Opting for an IP will allow you to adjust the coverage limit (still subject to deductibles and co-insurance).

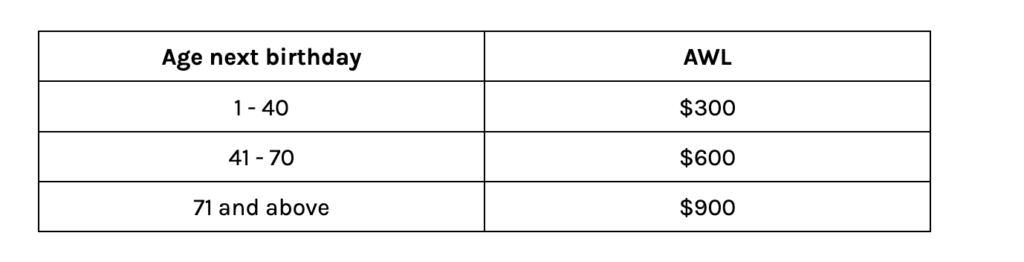

Although your MediShield Life premiums can be paid fully using MediSave, this is not the case for your IP premiums. There is an Additional Withdrawal Limit that caps the amount of MediSave that you can use to pay for the private insurance component of your IP.

Existing insurers offering IPs that are approved by the government include NTUC Income, AIA, Singlife, Prudential, Raffles, Great Eastern, and, AXA.

IP Riders

Another way to gain more comprehensive coverage is to purchase Riders. IP Riders can be added to IPs to reduce your out-of-pocket expenses such as deductibles and co-insurance.

As of 2 April 2021, all IPs with full riders have phased out. All IP riders will now be co-payment riders with a requirement of 5% co-payment of your hospital bill. This means that after you have paid the deductible, your insurer will pay up to 95% of your medical bill.

Fret not, insurers have capped the co-payment at $3000 to ensure that it remains affordable for their policyholders. A good point to note is that you can only pay IP rider premiums, deductibles, and co-insurance using cash. For more information on IPs and IP riders, please refer here.

Is MediShield Life Insurance Enough?

Earlier this year, there were changes to cancer treatment financing, which means that only treatments on the approved cancer drug list will be covered under MediShield Life.

Is MediShield Life enough to pay for the treatment(s) you need? Is MediShield Life likely to be enough to pay for your future healthcare expenses? Would you like to have your pre and pro hospitalisation costs covered? Flexibility to choose your preferred ward or even preferred doctor?

These are questions to think about to decide if MediShield Life coverage and benefits are sufficient for you. If it is not, then you might want to consider getting an IP with or without a rider.

Engage a financial advisor who will be able to better evaluate your situation and help you to understand which option is likely to work best for you.

For more advice about insurance planning, get in touch today.