Top of the table

2020,2021

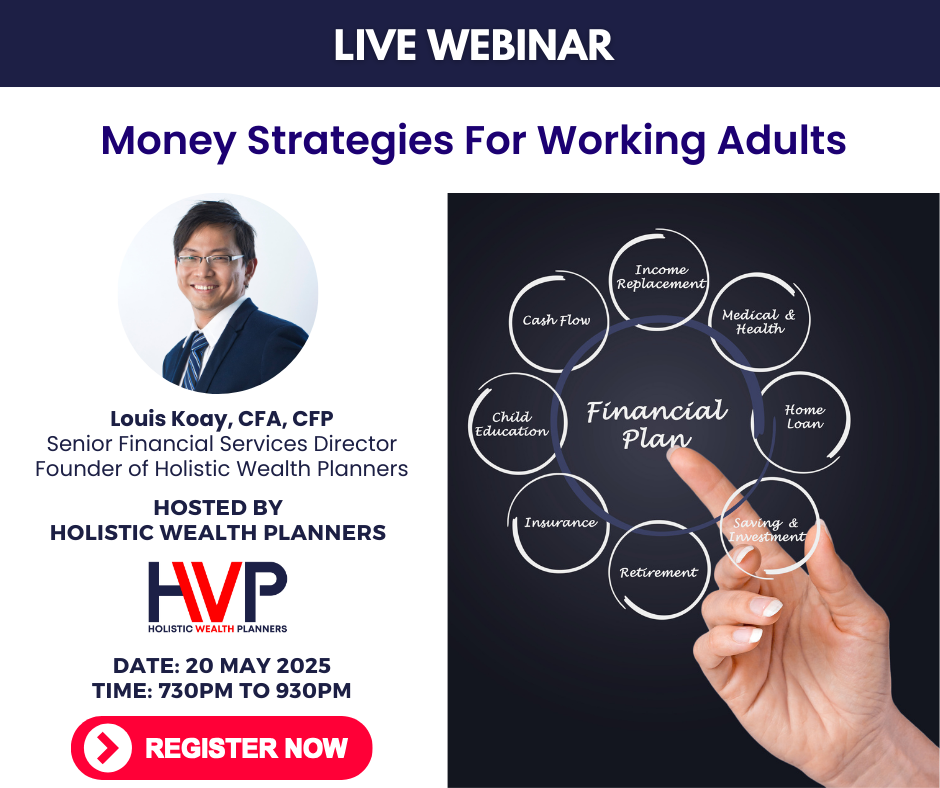

Louis Koay is a dual-licensed representative at Phillip Securities. He graduated from the National University of Singapore with First Class Honours and he is a CFA charterholder as well as a Certified Financial Planner. He is currently managing a team of 10 advisors and servicing more than 2,500 clients with asset under advisory of more than $40 million.

From financial consulting to investment and insurance

Wealth Planning should be done holistically. Insurance, investment, retirement planning are all interdependent. Get a holistic portfolio review from Louis

Sign up POEMS account to get dedicated investment service from Louis. Receive timely market updates and get invitation to monthly market outlook webinar

No time to invest on your own? Setup advisory account with Louis to follow Global Model Portfolio by Louis

Insurance planning is the foundation of financial planning. Get a holistic and independent insurance review and planning from Louis

Global Investment Portfolio for growth

Target ~8% yearly return

Global Dividend Portfolio for passive income

Target 5% annualised dividend payout on monthly basis

Securities Advisory portfolio in stocks

Target to outperform STI ETF

Show Track Record

follow Louis Model portfolio

35mil Assets Under Advisory

everything done for you

monthly personalised report with market commentary

skin in the game - Louis invest with his own money so you will never be left alone

Determine how much do you need for your retirement and how to achieve your retirement goal

For your regular financial review on cash flow, investment allocation and insurance analysis

To find out how you can achieve your financial freedom

To find out when is the most optimum age to start your Supplement Retirement Scheme (SRS) account

Career opportunities

testimonials

A financial consultant will work with you to get a complete picture of your assets, liabilities, income, and expenses. He will provide a detailed financial plan on how you can achieve your financial goals. Financial solutions will be provided to suit your financial needs. Insurance planning, investment planning, and retirement planning are often the key planning that a financial planner can work out for you.

Everyone is required to do proper and holistic financial planning. As we may have multiple financial goals to achieve but always with limited capital or budget, we need to plan our finances properly to achieve all financial goals.

I believe financial planning should be done holistically. Insurance, investment, and retirement planning are the three key pillars of planning. These three planning are all interdependent.

Typically, there will be three meetings for financial planning. The first meeting will be about understanding your financial goals, and collecting your financial data like your income, expenses, existing investment summary, and insurance summary. In the second meeting, I will provide my independent financial advice on how you can achieve your financial goals with the information provided. Financial solutions will be provided in the second meeting. The last meeting will be to adjust and execute the financial solutions.

A financial advisor can help to provide holistic financial planning for you. Financial advisors specialize in providing financial advice. He/she will speak to you to understand your needs and cover the missing financial plan that you may not be able to discover by yourself. A financial advisor can also help to construct an investment portfolio for you and provide constant monitoring and rebalancing for your investment portfolio

A holistic financial planner can help you to construct a holistic picture of your current financial situation. Having a holistic financial planner can help you to get detailed financial planning to achieve your multiple financial goals. You should do holistic planning before you commit to any financial products.

Financial planning is the initial process to engage with a financial advisor. The financial planning is complimentary. A financial planner will get the financial planning fee from the solutions that are provided to you or the investment advisory fee under his management. There is no extra cost for financial planning and this is why you should always do financial planning before getting into any financial products.

I am a Certified Financial Planner and Chartered Financial Analyst. I have done more than 1500 financial planning for my clients since 2015. I am advising more than 40 million assets under advisory. I have also trained more than 200 financial advisors in my company to provide financial planning. Every year, I have to attend more than 30 hours of training to keep myself updated on the current financial markets

Yes. I am a licensed financial advisor and use the Phillip Securities platform to execute financial advice. You can find my name on the MAS register of representatives here.

Disclaimer and PDPA: Click Here